Strong Q2 Report: 7 Key Highlights for Investors in 2024

Strong Q2 Report: 7 Key Highlights for Investors in 2024

The latest earnings season is in full swing, and one company’s results are creating significant buzz among investors. The release of a particularly strong Q2 report has not only surpassed Wall Street expectations but also painted a picture of robust health and strategic execution. For current and prospective investors, understanding the details behind the headline numbers is crucial for making informed decisions. This report signals more than just a good quarter; it points toward sustainable momentum heading into the second half of 2024.

In this article, we’ll break down the seven most important highlights from this impressive earnings release and what they mean for the company’s future trajectory.

1. Record-Breaking Revenue Growth

The most striking figure from the report was the top-line revenue. The company reported a 22% year-over-year increase in quarterly revenue, landing comfortably above the consensus analyst estimate. This isn’t just a minor beat; it’s a statement of market dominance and effective sales strategy. The growth was broad-based, with all major product segments contributing positively.

This surge indicates that demand for the company’s offerings remains incredibly high, even in a complex macroeconomic environment. For investors, this demonstrates a resilient business model and an ability to capture market spending effectively. It’s a key reason many are calling this such a strong Q2 report.

2. Expanding Profit Margins Signal Efficiency

While revenue growth is exciting, profitable growth is what truly matters. This Q2 report delivered on that front as well. Gross margins expanded by 150 basis points to 58.5%, and operating margins saw an even more impressive jump. This highlights the company’s success in managing its cost of goods sold and controlling operational expenses.

These efficiency gains suggest that the company is scaling effectively. It’s not just selling more; it’s selling more, more profitably. This operational leverage is a powerful catalyst for long-term shareholder value and a core component of a healthy investment thesis. It shows that management is focused on both growth and the bottom line, a duality investors love to see.

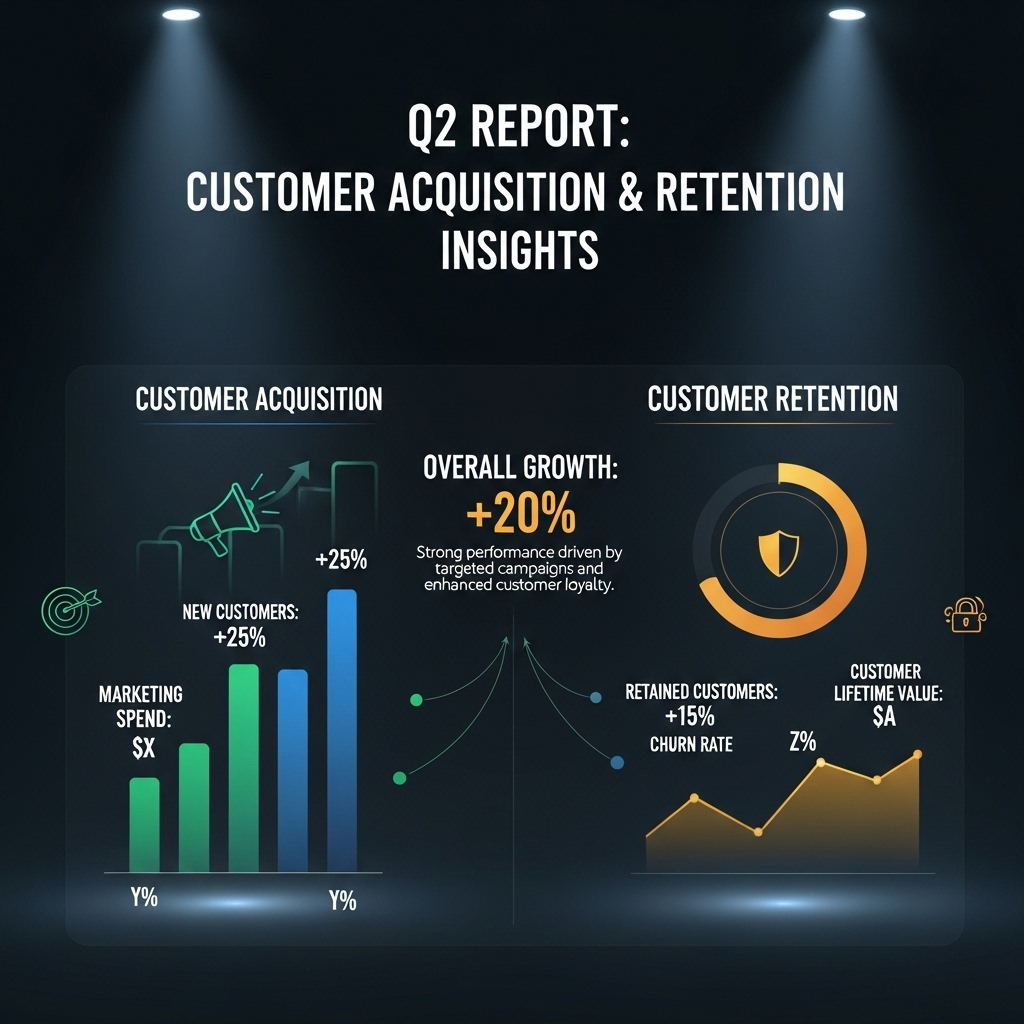

3. Unpacking the Strong Q2 Report’s Customer Growth

A business is nothing without its customers, and this quarter saw remarkable growth in the user base. The company added over 2 million new active users, a significant acceleration from previous quarters. Furthermore, the report highlighted a decrease in customer acquisition cost (CAC) while simultaneously increasing the lifetime value (LTV) of each customer.

This LTV/CAC ratio improvement is a critical metric, indicating a highly efficient marketing engine and a “sticky” product that customers value. Strong retention figures, which were also noted in the report, confirm this. For more context on market trends affecting customer behavior, check out our analysis on 2024 market trends.

4. Product Innovation and R&D Success

A strong quarter is often built on the back of successful product launches. The report detailed the overwhelmingly positive reception of its new flagship product, which launched early in Q2. Initial sales data for this product line are already exceeding internal projections by over 30%.

Furthermore, the company reiterated its commitment to research and development, increasing its R&D budget for the remainder of the year. This forward-looking investment signals that management is not resting on its laurels but is actively building the next generation of products to fuel future growth. This commitment to innovation is a key pillar supporting long-term investor confidence.

5. Significant Gains in Key Market Share

Beating your own records is one thing; taking business from competitors is another. Independent market analysis cited in the investor presentation confirmed that the company gained 2% market share in its primary industry category during the quarter. This is a substantial move in a competitive landscape.

These gains were attributed to a combination of superior product features and a more aggressive go-to-market strategy. Stealing share indicates that the company’s value proposition is resonating more strongly with customers than its rivals’—a powerful indicator of a widening competitive moat. This type of performance is often highlighted by financial news outlets like Reuters as a sign of a market leader.

6. A Fortified Balance Sheet

Beyond the income statement, the balance sheet revealed excellent financial health. The company successfully reduced its long-term debt by $500 million this quarter while simultaneously increasing its cash and cash equivalents to a record high. This deleveraging strengthens the company’s financial foundation and provides immense flexibility.

A strong balance sheet allows the company to weather economic downturns, pursue strategic acquisitions, or invest heavily in growth without relying on external financing. For investors, this reduces risk and increases the potential for capital return programs, like dividends or share buybacks, in the future. It’s a crucial, if often overlooked, element of this strong Q2 report and builds on the progress seen in the previous quarter’s results.

7. Upgraded Full-Year Guidance

Perhaps the most forward-looking highlight was management’s decision to raise its full-year guidance for both revenue and earnings per share (EPS). The new forecast is significantly above what analysts had been modeling, reflecting management’s supreme confidence in the business’s momentum.

Raising guidance is a powerful signal. It tells the market that the success of Q2 was not a fluke but part of a sustainable trend. This act of confidence often leads to a re-rating of the stock by analysts and can provide a significant tailwind for the share price. The upgraded forecast provides a clear, optimistic roadmap for the rest of 2024, giving investors a compelling reason to stay engaged.