Deep Fission Goes Public: 5 Details on the Curious SPAC

Deep Fission Goes Public: 5 Details on the Curious SPAC

The world of special purpose acquisition companies (SPACs) just got a jolt of seismic energy. The announcement that Deep Fission, a secretive geothermal energy startup, intends to go public has sent ripples through the tech and investment communities. This move promises to bring a disruptive new player to the public markets, but the deal is shrouded in as much mystery as the geological depths the company aims to exploit.

For investors eyeing the next big thing in green tech, understanding the nuances of the Deep Fission SPAC is critical. It represents a bet on a potentially revolutionary technology that could redefine renewable energy. Here are five essential details you need to know about this curious public debut.

Article Contents

1. What Exactly is Deep Fission?

At its core, Deep Fission is not a nuclear energy company, despite its evocative name. Instead, it operates in the advanced geothermal energy sector. For years, the company has operated in “stealth mode,” leaving much of the industry to speculate about its technology. The SPAC announcement has finally pulled back the curtain.

The company’s mission is to unlock the planet’s virtually limitless core heat by drilling deeper than any conventional geothermal project has before. Their proprietary technology is reportedly a “plasma boring” system that uses superheated plasma to vitrify rock, essentially melting its way through the earth’s crust with unprecedented speed and efficiency. This would allow them to bypass the geographical limitations of traditional geothermal, which relies on finding existing hot spots close to the surface.

If successful, Deep Fission could establish power plants anywhere in the world, providing a constant, reliable source of clean energy. The company claims its approach is safer, more scalable, and has a smaller environmental footprint than any other baseload power source. This bold claim is the central pillar of its investment thesis.

2. The SPAC Partner: A Look at Momentum Acquisition Corp. III

A SPAC deal is a partnership, and the other half of this equation is Momentum Acquisition Corp. III (NASDAQ: MACCU). This is the third blank-check company from sponsor Momentum Ventures, a group with a mixed but interesting track record. Their first SPAC successfully merged with a satellite logistics company, which has performed modestly on the market. Their second, however, failed to find a target and was liquidated.

This history makes their choice of Deep Fission particularly noteworthy. Momentum Acquisition Corp. III raised $300 million in its IPO with the stated goal of finding a “category-defining technology company with a strong ESG (Environmental, Social, and Governance) profile.” Deep Fission certainly fits that description, but its pre-revenue status makes it a much riskier bet than many SPAC sponsors are willing to take in the current market climate.

The “curious” nature of this deal stems from this pairing: a highly speculative, moonshot technology company merging with a SPAC sponsor that needs a definitive win. Investors should look closely at the sponsor’s incentives and their ability to guide a complex company like Deep Fission through its early years on the public market. For more on how these vehicles work, you can read our guide on the basics of SPACs.

3. Unpacking the Deal’s Valuation and Structure

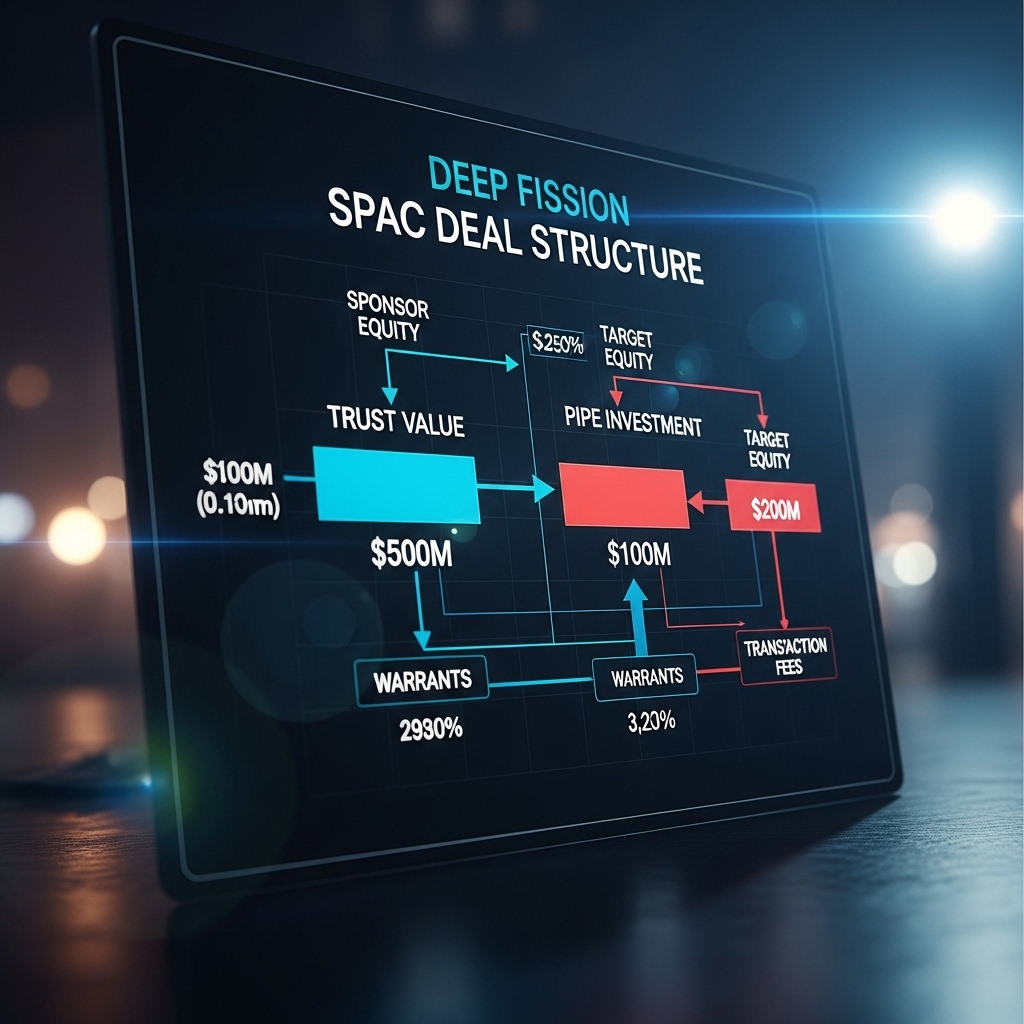

The deal values the combined entity at a pro-forma enterprise value of $1.5 billion. This is a significant valuation for a company that has yet to generate a single dollar of revenue. The transaction is expected to provide Deep Fission with up to $375 million in gross proceeds.

This funding is composed of two parts:

- $300 million held in Momentum Acquisition Corp. III’s trust account (assuming no shareholder redemptions).

- $75 million from a PIPE (Private Investment in Public Equity) from a small group of institutional and strategic investors.

The relatively small size of the PIPE is a potential red flag. In many successful SPAC deals, a large, oversubscribed PIPE is seen as a vote of confidence from sophisticated investors who have done their due diligence. The $75 million figure suggests either a lack of broad institutional interest or that the company and its sponsor wanted to limit dilution. The company states the funds will be used to build its first full-scale commercial demonstration drill rig and secure initial site permits.

4. The Leadership Behind Deep Fission: Visionaries or Gamblers?

A company with such grand ambitions requires a unique leadership team. The team behind Deep Fission is a compelling mix of academic brilliance and industrial grit.

The CEO is Dr. Alistair Finch, a charismatic physicist with a background in advanced propulsion systems at a major aerospace agency. Dr. Finch is the visionary, known for his compelling presentations on the future of energy and humanity’s potential to become a “Type 1 civilization” on the Kardashev scale. He is the face of the company and is responsible for selling the dream to investors.

Balancing his vision is CTO and co-founder Elena Rosales, a pragmatic geophysicist who spent two decades in the oil and gas industry. She is credited with developing the core plasma boring technology after growing disillusioned with fossil fuels. Rosales is the grounded operator, focused on the immense engineering challenges ahead. This pairing of a dreamer and a doer is powerful, but also highlights the tension between the company’s long-term vision and its short-term execution risks.

5. Risks and Red Flags Investors Should Watch

No investment is without risk, and a pre-revenue deep-tech SPAC is at the highest end of the risk spectrum. While the potential reward is immense, investors must be clear-eyed about the hurdles facing Deep Fission.

Technological Risk: The plasma boring technology has only been proven in small-scale, controlled lab environments. Scaling it to drill miles into the earth’s crust presents monumental and unknown engineering challenges. There is a significant chance the technology will not be viable at a commercial scale or on a cost-competitive basis.

Financial Risk: The company is burning cash and will continue to do so for the foreseeable future. The projected $375 million in proceeds may seem large, but it can be depleted quickly on a project of this magnitude. Furthermore, the risk of high shareholder redemptions from the SPAC could mean Deep Fission receives far less cash than anticipated, potentially jeopardizing its entire roadmap.

Market Risk: While Deep Fission’s solution is unique, it will compete in a crowded energy market. Advances in solar, wind, battery storage, and even nuclear fusion could make geothermal less attractive by the time the company is ready to deploy commercially.

For a detailed overview of the risks associated with these investment vehicles, the U.S. Securities and Exchange Commission offers a helpful Investor Bulletin on SPACs.

The Final Word

The Deep Fission SPAC is one of the most exciting—and speculative—public offerings in recent memory. It’s a pure-play bet on a revolutionary technology that could fundamentally alter the global energy landscape. The leadership team is impressive, and the mission is undeniably inspiring.

However, the path forward is fraught with technological, financial, and market risks. Success is far from guaranteed. For investors with a high tolerance for risk and a long-term horizon, Deep Fission may represent a ground-floor opportunity. For most others, it’s a fascinating story to watch from the sidelines as we wait to see if they can truly turn science fiction into reality.

“`