Holy Holdings: 1st Christian Values ETF on Wall Street

Holy Holdings: 1st Christian Values ETF on Wall Street

Wall Street has a new player, and it’s guided by principles that are thousands of years old. The launch of the Holy Holdings ETF marks a significant moment in the financial world, officially introducing the first exchange-traded fund explicitly designed to align with Christian values. For investors who have long sought to marry their faith with their financial strategy, this new fund offers a unique and accessible opportunity. This article will delve into what the “holy holdings” philosophy entails, how it works, and what it means for the future of values-based investing.

What Exactly is the Holy Holdings ETF?

The Holy Holdings ETF, trading under the ticker symbol HLYH, is an exchange-traded fund that aims to invest in a portfolio of U.S. companies that operate in accordance with Christian values. Managed by the newly formed FaithFirst Capital Group, HLYH is not just another thematic fund; it represents a dedicated effort to provide a financial product that reflects the moral and ethical convictions of Christian investors.

At its core, an ETF is a basket of securities—like stocks—that you can buy or sell on a stock exchange, just like a single stock. The Holy Holdings ETF pools investor money to buy shares in dozens of companies that have passed its rigorous faith-based screening process. This provides investors with instant diversification across a range of businesses deemed ethically sound.

The fund’s objective is twofold: to seek long-term capital appreciation while upholding key tenets of the Christian faith. The managers of HLYH believe that companies built on strong ethical foundations are more likely to achieve sustainable, long-term success. With a competitive expense ratio of 0.45%, it is positioned to compete with other popular ESG (Environmental, Social, and Governance) funds on the market.

The Biblical Blueprint: How Companies Are Screened

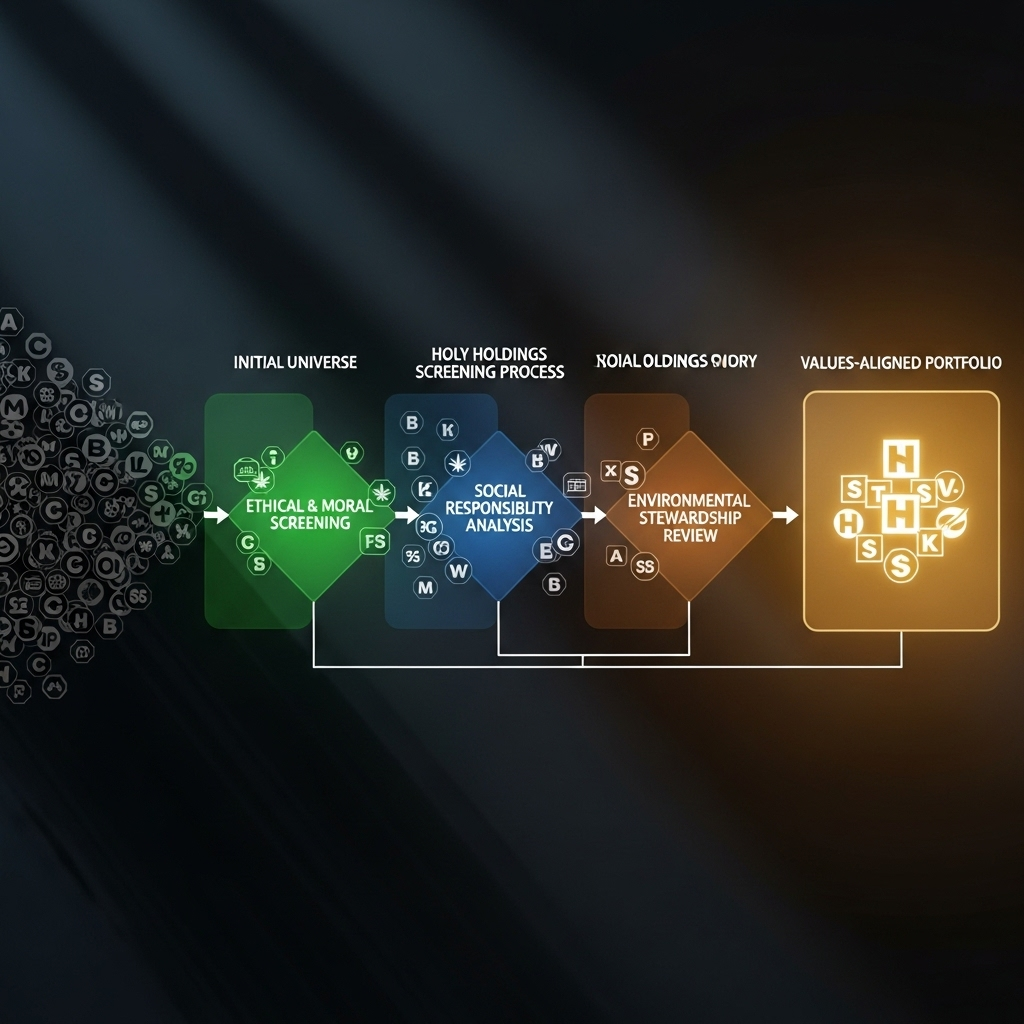

The selection process for the companies included in the holy holdings portfolio is what truly sets this ETF apart. FaithFirst Capital employs a multi-stage screening methodology advised by a board of theologians, community leaders, and financial experts. This process involves both “negative” and “positive” screens.

Negative screening is the process of exclusion. HLYH will not invest in companies that derive a significant portion of their revenue from activities considered inconsistent with Christian ethics. These excluded industries include:

- Alcohol and tobacco production

- Gambling and casino operations

- Pornography and adult entertainment

- Companies involved in abortion services or manufacturing abortifacients

- Weapon manufacturers involved in non-military or controversial arms

Conversely, positive screening actively seeks out companies that demonstrate virtues and practices aligned with Christian values. The fund’s managers look for businesses with strong track records in areas such as:

- Ethical Leadership: Companies with a reputation for integrity, transparency, and fair corporate governance.

- Employee Care: Businesses that offer fair wages, safe working conditions, and promote a healthy work-life balance.

- Community Stewardship: Corporations that engage in charitable giving, community service, and responsible environmental practices.

- Family Values: Companies that produce products and services that support and strengthen the family unit.

This dual approach ensures the portfolio is not just “less bad” but actively “good,” according to the fund’s guiding principles.

Market Impact and the Rise of Faith-Based Investing

The arrival of the Holy Holdings ETF is a powerful indicator of the growing demand for values-based investment products. While ESG investing has been a dominant trend for years, faith-based investing is carving out its own significant niche. Investors are increasingly demanding that their capital not only generates returns but also reflects their personal identity and moral compass.

“We’re seeing a ‘personalization’ of finance,” notes one market analyst. “People want their coffee fair-trade, their clothes ethically sourced, and now, their stock portfolios to be morally clean. The HLYH fund directly serves a large, underserved demographic of Christian investors who have been waiting for a product like this.”

This trend isn’t limited to Christianity. Islamic finance, which adheres to Sharia law, has a well-established global presence with its own set of funds that avoid interest (riba) and investments in industries like pork and alcohol. The success of these products demonstrates a clear market for faith-aligned financial instruments. The Holy Holdings ETF is simply Wall Street’s answer to a similar call from the Christian community.

How to Invest in Holy Holdings

Investing in the Holy Holdings ETF is as straightforward as buying any other stock or ETF. For those interested, the process is simple:

- Open a Brokerage Account: If you don’t already have one, you’ll need to open an account with a major brokerage firm like Charles Schwab, Fidelity, Vanguard, or a modern platform like Robinhood.

- Fund Your Account: Deposit funds into your brokerage account via a bank transfer.

- Search for the Ticker: Use the platform’s search function to look up the ticker symbol HLYH.

- Place Your Order: Decide how many shares you want to purchase and place a “buy” order.

Before investing, it is crucial to perform due diligence. This means reading the fund’s prospectus, which contains detailed information about its investment strategy, holdings, fees, and risks. You can find this document on the FaithFirst Capital website or through the SEC’s EDGAR database. Consulting with a qualified financial advisor to see if HLYH fits your overall financial goals and risk tolerance is also highly recommended. (For more on ETFs, check out our guide on understanding ETFs).

Balancing Faith and Finance: Potential Risks and Rewards

Like any investment, the Holy Holdings ETF comes with its own set of potential risks and rewards. Investors must weigh these carefully.

Potential Rewards

The most significant reward is the ability to align your portfolio with your faith. For many, this non-financial return is invaluable. Furthermore, the fund’s focus on ethically-run companies could be a source of financial strength. Companies with strong governance and employee satisfaction often exhibit greater stability and long-term growth potential. By investing in HLYH, you become part of a movement that uses capital to encourage positive corporate behavior.

Potential Risks

The primary risk is a lack of diversification. By excluding entire sectors like alcohol, tobacco, and certain areas of healthcare and defense, the fund’s performance may deviate significantly from the broader market, such as the S&P 500. If those excluded sectors have a period of strong performance, HLYH may underperform. There is also “purity risk”—if a company held by the fund becomes embroiled in a scandal that violates the fund’s principles, it could lead to a forced sale and potential negative press, impacting the ETF’s value.

Ultimately, the Holy Holdings ETF represents a bold new chapter in personal finance. It offers a tangible way for investors to put their money where their faith is, betting on the idea that doing good and doing well can go hand-in-hand. Whether it becomes a cornerstone of faith-based finance or remains a niche product, its launch has undeniably sent a message: on Wall Street, values are becoming a valuable commodity.

“`