Strong Q2 Report: 5 Key Takeaways for Investors in 2024

Strong Q2 Report: 5 Key Takeaways for Investors in 2024

As the latest earnings season unfolds, one company’s results are making significant waves across the market. The release of a particularly strong Q2 report has captured the attention of analysts and investors, providing a bullish outlook in a mixed economic environment. For those looking to make informed decisions for the remainder of 2024, dissecting these quarterly results is not just useful—it’s essential.

A company’s quarterly report is a detailed health check, offering a transparent look into its performance, challenges, and future prospects. This recent report showcases robust fundamentals and strategic execution that beat expectations. Below, we break down the five most critical takeaways from this impressive financial release.

Table of Contents

- 1. Revenue Growth That Smashed Expectations

- 2. Significant Margin Expansion and Profitability

- 3. A Deeper Dive into the Strong Q2 Report’s Customer Growth

- 4. Balance Sheet Fortification and Impressive Cash Flow

- 5. Upgraded Guidance Signals Confidence for H2 2024

- What This Means for Your Investment Strategy

1. Revenue Growth That Smashed Expectations

The headline number that immediately stands out is the top-line revenue. The company reported quarterly revenue of $5.2 billion, a remarkable 18% increase year-over-year. This figure comfortably surpassed Wall Street’s consensus estimate of $4.9 billion, signaling powerful demand for its products and services.

This isn’t just a marginal beat; it’s a statement. Such significant growth suggests that the company is not only retaining its existing customer base but is also successfully capturing new market share. The growth was broad-based, with its core segments all reporting double-digit increases. This indicates that the company’s success isn’t reliant on a single product line but is instead a result of a well-rounded and effective corporate strategy.

For investors, this powerful revenue growth is a primary indicator of a healthy, expanding business with strong pricing power and a competitive moat.

2. Significant Margin Expansion and Profitability

While top-line growth is crucial, savvy investors know that profitability tells the other half of the story. In this area, the company delivered another resounding success. The Q2 report revealed a non-GAAP gross margin of 62%, up from 58% in the same quarter last year. This expansion is a testament to the company’s operational efficiency and ability to manage costs effectively, even amidst lingering inflationary pressures.

More impressively, the operating margin expanded by 300 basis points to 25%. This improvement flows directly down to the bottom line, resulting in earnings per share (EPS) of $1.45, which was $0.20 higher than analyst predictions. This demonstrates that the company is not just growing; it’s growing more profitably.

This margin expansion suggests a scalable business model where each additional dollar of revenue generates proportionally more profit—a highly attractive quality for long-term investors.

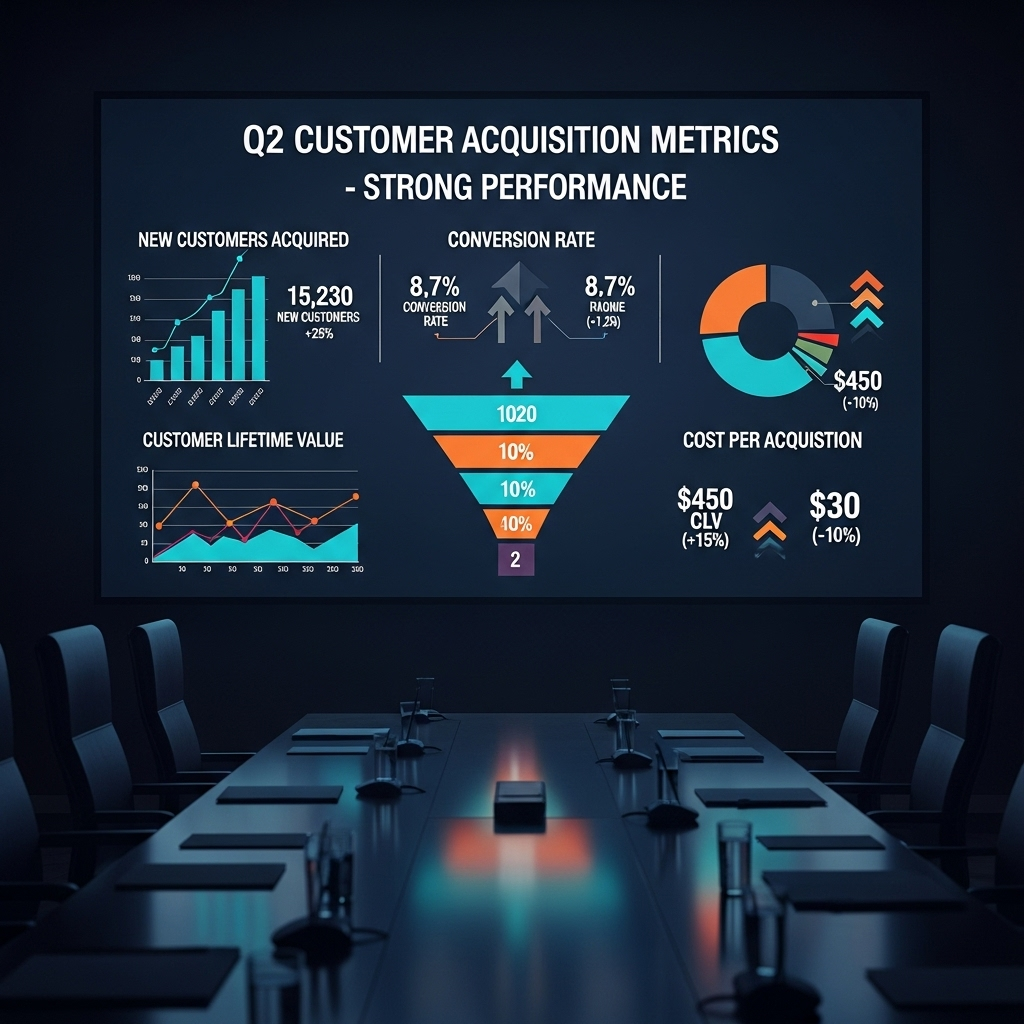

A Deeper Dive into the Strong Q2 Report’s Customer Growth

A strong Q2 report is often built on the foundation of a growing and engaged customer base. This report was no exception. The company announced a 22% year-over-year increase in Monthly Active Users (MAUs), reaching a new record high. This metric shows that the user base is not only expanding but also actively engaging with the company’s platform and services.

Furthermore, the company reported a decrease in Customer Acquisition Cost (CAC) while simultaneously seeing an increase in Customer Lifetime Value (CLV). This is the holy grail for growth-focused companies. It means they are spending less to acquire new customers who, in turn, are spending more over their lifetime with the business. This sustainable growth model is a key reason for the positive investor sentiment following the report.

These user metrics confirm that the revenue growth is not a temporary fluke but is supported by fundamental, long-term customer loyalty and engagement trends.

Balance Sheet Fortification and Impressive Cash Flow

Beyond the income statement, the balance sheet provides a critical snapshot of financial health. The Q2 report highlighted a fortress-like balance sheet, with cash and cash equivalents rising to $8.1 billion. The company has been diligently managing its debt, with a healthy debt-to-equity ratio that provides significant financial flexibility.

Perhaps the most impressive figure was the free cash flow (FCF), which came in at $1.3 billion for the quarter. Strong free cash flow is the lifeblood of any company, enabling it to reinvest in growth, pay down debt, issue dividends, or buy back shares. This robust FCF generation underscores the quality of the company’s earnings and its ability to fund its own operations without relying on external financing.

Investors can take comfort in this financial stability, as it equips the company to navigate potential economic headwinds and seize opportunities for strategic acquisitions or investments. For a more detailed guide on analysis, consider reading about understanding key financial statements.

Upgraded Guidance Signals Confidence for H2 2024

Perhaps the most forward-looking takeaway is the company’s revised guidance for the second half of the year. Buoyed by the exceptional Q2 performance, management raised its full-year revenue forecast from a range of $19.5B-$20B to a new, higher range of $20.5B-$21B. They also increased their EPS guidance for the full year.

This upgraded guidance is a powerful signal of management’s confidence in the business’s trajectory. It suggests that the momentum seen in Q2 is expected to continue through the end of 2024. For investors, this reduces uncertainty and provides a clearer roadmap for what to expect in the upcoming quarters. When a leadership team publicly raises its targets, it indicates they have strong visibility into their sales pipeline and operational runway.

What This Means for Your Investment Strategy

In summary, this strong Q2 report was a masterclass in execution. From smashing revenue expectations and expanding profit margins to growing the customer base and strengthening the balance sheet, the company checked all the right boxes. The upgraded guidance for the rest of 2024 was the cherry on top, cementing a bullish narrative.

For investors, these takeaways offer a compelling case for the company’s robust health and promising future. The report demonstrates a business that is not just surviving but thriving, with multiple levers for growth and a resilient financial foundation. While past performance is no guarantee of future results, this quarter’s results provide a clear and encouraging data point for anyone evaluating their portfolio for the year ahead.

“`