Teck Resources in $41B Merger with Anglo American

Teck Resources in $41B Merger with Anglo American

In a landmark move set to reshape the global mining landscape, Canadian mining giant **Teck Resources** has agreed to a blockbuster $41 billion merger with the diversified mining multinational, Anglo American. The deal creates a new powerhouse with an unparalleled portfolio in copper, steelmaking coal, and other future-facing commodities, positioning the combined entity as a leader in the global transition to a low-carbon economy.

This historic merger combines the high-quality copper and metallurgical coal assets of **Teck Resources** with Anglo American’s vast and diversified operations in copper, platinum group metals, and iron ore. The new company, which will operate under a name to be announced pending regulatory approval, is expected to have a combined market capitalization of over $70 billion.

Table of Contents

- The Deal at a Glance: Anatomy of a Mining Behemoth

- Strategic Rationale: A Focus on Copper and Decarbonization

- What This Means for Teck Resources Shareholders

- Navigating the Global Regulatory Gauntlet

- The Future of a Diversified Mining Supermajor

The Deal at a Glance: Anatomy of a Mining Behemoth

The agreement, valued at approximately **$41 billion USD**, is structured as a majority-stock transaction. Under the terms of the deal, shareholders of **Teck Resources** will receive 0.78 shares of Anglo American for each Teck share they hold, representing a significant premium over Teck’s recent trading averages. The transaction has been unanimously approved by the boards of directors of both companies.

Key details of the merger include:

- Leadership: Anglo American’s current CEO, Duncan Wanblad, is slated to lead the new combined entity, while two members from the Teck board will join the new board of directors to ensure a smooth integration.

- Headquarters: The new company will maintain a global headquarters in London, with a significant North American corporate presence remaining in Vancouver, Canada, acknowledging the deep operational roots of **Teck Resources**.

- Asset Portfolio: The merger creates a world-leading copper producer, combining Teck’s operations in Chile and Canada with Anglo’s assets in Chile and Peru. This copper portfolio is seen as the crown jewel of the deal.

The transaction is expected to close in the third quarter of 2026, subject to customary closing conditions, including shareholder approval from both companies and regulatory clearance from multiple international jurisdictions.

A Focus on Copper and Decarbonization

The primary driver behind this monumental merger is the shared vision of creating a leader in “future-facing” commodities. Both Anglo American and **Teck Resources** have identified copper as a critical metal for the 21st century, essential for everything from electric vehicles and renewable energy infrastructure to modern electronics.

By combining their portfolios, the new entity will have the scale and technical expertise to develop and operate the next generation of large-scale, low-cost copper mines. This scale is crucial for meeting the projected surge in copper demand driven by global **decarbonization efforts**.

Furthermore, the diversification of the new company’s portfolio is a major strategic advantage. While Teck brings world-class metallurgical coal assets—vital for steel production—Anglo American adds its significant holdings in platinum group metals (PGMs), which are essential for hydrogen technology and vehicle catalytic converters. This blend creates a more resilient business, capable of weathering the cyclical nature of individual commodity markets. You can read more in our complete analysis of mining sector trends.

What This Means for Teck Resources Shareholders

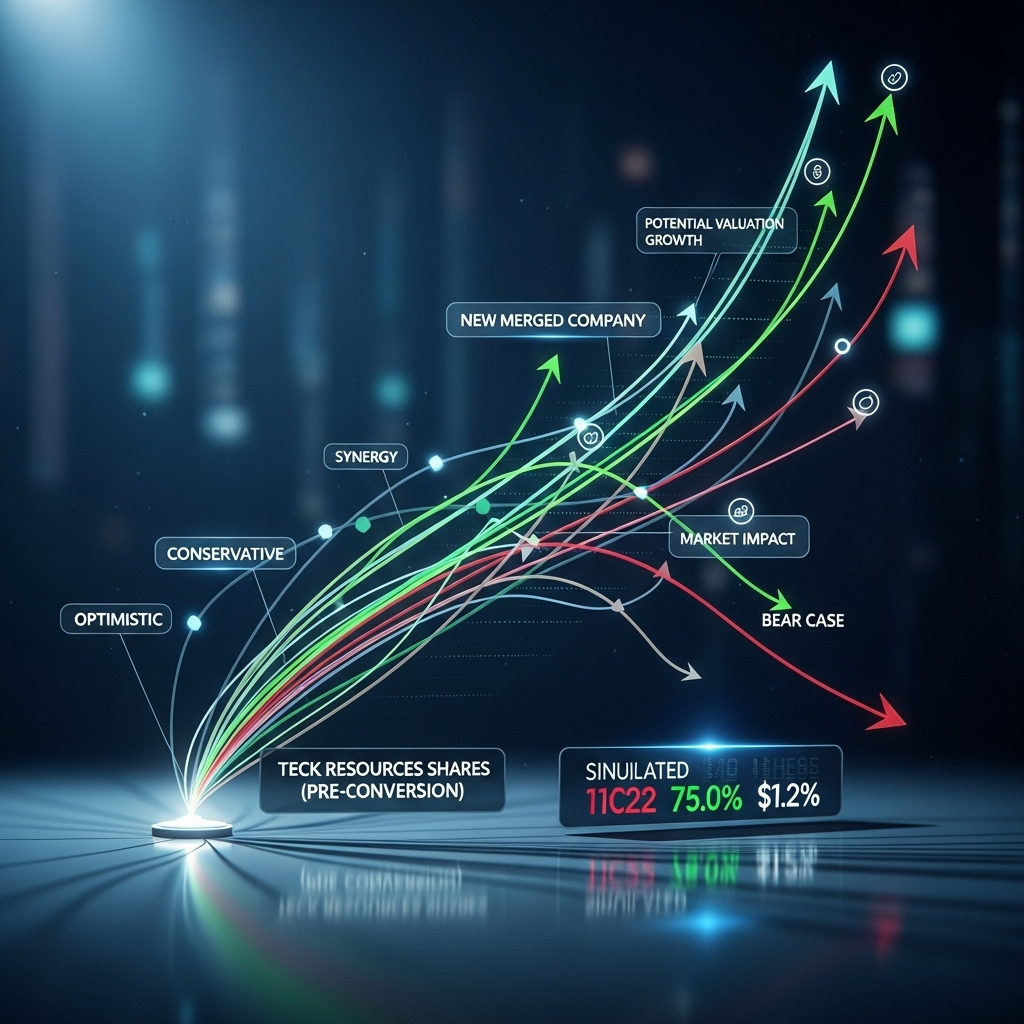

For shareholders of **Teck Resources**, the merger presents a compelling value proposition. The offer represents a premium of approximately 25% to Teck’s 30-day volume-weighted average share price, providing an immediate and substantial return. More importantly, it allows them to exchange their shares for a stake in a larger, more diversified, and financially robust global leader.

Market analysts have reacted positively, noting that the deal unlocks value that might have been difficult for **Teck Resources** to achieve on its own. The integration with Anglo American’s global logistics, advanced mining technology, and diverse asset base is expected to generate significant long-term synergies.

The new entity will have a stronger balance sheet, enhancing its ability to fund ambitious growth projects and return capital to shareholders through dividends and buybacks. Investors seeking more detailed financial breakdowns can find them on official sources like Anglo American’s investor relations page.

Navigating the Global Regulatory Gauntlet

A merger of this magnitude will inevitably face intense scrutiny from competition authorities around the world. The combined entity’s dominant position in the seaborne metallurgical coal market and its significant share of global copper production will be key areas of focus for regulators in Canada, China, Japan, the European Union, and the United States.

Both **Teck Resources** and Anglo American have assembled legal teams to begin the complex process of securing approvals. It is widely anticipated that the companies may need to agree to certain conditions, such as divesting specific smaller assets, to alleviate concerns about market concentration.

The Canadian government, in particular, will review the deal under the Investment Canada Act to ensure it provides a “net benefit” to the country, considering factors like employment, capital investment, and the location of key corporate functions. The commitment to maintaining a major corporate office in Vancouver is a direct attempt to address these potential concerns.

The Future of a Diversified Mining Supermajor

The merger between **Teck Resources** and Anglo American is more than just a financial transaction; it’s a strategic repositioning for the future of resource extraction. The new company is being built to thrive in a world increasingly focused on **sustainability and electrification**.

With a leading portfolio in copper and a strong commitment to ESG (Environmental, Social, and Governance) principles, the combined firm will be well-positioned to attract investment and talent. Its enhanced financial capacity will allow it to invest heavily in innovative mining technologies that reduce water usage, minimize environmental impact, and improve worker safety. For more on this, see our outlook on the future of the copper market.

As the world demands more of the essential materials needed to build a greener future, this new mining giant, born from the strategic union of Teck Resources and Anglo American, is poised to become one of the most influential suppliers on the planet.